desertsafaridxb.online

News

How Much Can Chase Overdraft

Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts. Many of our cards offer rewards that can be. You can withdraw money daily at an ATM or visit one of 4, Chase branches. Zelle is also integrated into the Chase app, so you can send and receive money in. We charge a $34 Overdraft Fee per transaction during our nightly processing beginning with the first transaction that overdraws your account balance by more. Chase previously had waived overdraft fees on accounts overdrawn by $50 or less and last year announced that, starting in , it would let customers have. What it costs. We charge a $34 Overdraft Fee per transaction during our nightly processing beginning with the first transaction that overdraws your account. Chase Debit Card Coverage: You can choose how we treat your everyday Whether your overdraft will be paid is at Chase's discretion, and we reserve. Overdraft: Chase pays a transaction during our nightly processing on a business day when your account balance is overdrawn $34 Overdraft Fee per transaction. How much does Wells Fargo's Overdraft Protection cover?Expand. For linked savings accounts: If the available balance in your savings account is $25 or more. We have three overdraft services to help you: Standard Overdraft Practice, Overdraft Protection (optional), Debit Card Coverage (optional, auto-enrolled). Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts. Many of our cards offer rewards that can be. You can withdraw money daily at an ATM or visit one of 4, Chase branches. Zelle is also integrated into the Chase app, so you can send and receive money in. We charge a $34 Overdraft Fee per transaction during our nightly processing beginning with the first transaction that overdraws your account balance by more. Chase previously had waived overdraft fees on accounts overdrawn by $50 or less and last year announced that, starting in , it would let customers have. What it costs. We charge a $34 Overdraft Fee per transaction during our nightly processing beginning with the first transaction that overdraws your account. Chase Debit Card Coverage: You can choose how we treat your everyday Whether your overdraft will be paid is at Chase's discretion, and we reserve. Overdraft: Chase pays a transaction during our nightly processing on a business day when your account balance is overdrawn $34 Overdraft Fee per transaction. How much does Wells Fargo's Overdraft Protection cover?Expand. For linked savings accounts: If the available balance in your savings account is $25 or more. We have three overdraft services to help you: Standard Overdraft Practice, Overdraft Protection (optional), Debit Card Coverage (optional, auto-enrolled).

Under Chase's standard overdraft practices, Chase will charge you a $34 insufficient funds fee per item if it pays for you unless your Chase account balance is. You will be charged this fee even if your account is overdrawn by $5 or less. Overdraft Protection. Transfer Fee. (If you are enrolled). $10 for each day when. do so,” the overdraft fee lawsuit said. “In many instances, these overdraft fees cost the banks' account holders hundreds of dollars in a matter of days, or. Based on your account history, the deposits you make and the amount of the transaction, we may cover the overdraft transaction for you and charge a $ Confidence: $0 overdraft fees if you're overdrawn by $50 or less at the end of the business day. Depends on if you have overdraft or bounce protection. Generally they will allow a certain amount to be overdrawn and paid at the expense of an overdraft fee. See our Chase Total Checking offer for new checking customers. Check out our bank account without overdraft fees. View FAQs, how-to videos and other resources. Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts. Footnote 2. Chase Mobile® app is available for select. The Chase Secure Banking checking account won't charge you overdraft fees, and new users can earn $ You'll pay $34 per overdraft. Chase caps daily overdraft fees at three, so you could pay up to $ per day. ATM fees. If you use a non-Chase ATM. It really depends on your bank's policies with regard to the type of account you have with them. Usually, it can be between $0 and $1, for a. At Chase, you will be charged a $35 overdraft fee per transaction and they can charge you up to 3 times a day (if you do 3 transactions). Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts. Footnote 8. Special Provisions for Card Transactions. These charges include Chase overdraft fees, monthly services fees, checking account fees, wire transfer fees, and ATM fees for using a non-Chase machine. This overdraft coverage could result in an overdraft fee that's generally between $20 and $40, depending on your bank's policies. Some banks may charge a. You can be charged a maximum of 3 Chase overdraft fees per day. But those fees will be refunded if your account balance is overdrawn by $5 or less at the end of. How Does Hour Grace work on overdrafts and returns? We will not charge an overdraft fee unless your account is overdrawn by more than $ When your. Some banks, though, have eliminated overdraft fees altogether and offer other options to their banking clients. How Can I Stop Overdrawing My Checking Account? Pay bills, cash checks, and send money with Chase Secure Banking SM, a checking account with no overdraft fees and no fees on most everyday transactions. M posts. Discover videos related to How Do I Know My Chase Overdraft Limit on TikTok. See more videos about How to Delete A Draft, How to Run Quicker.

How To Take A Loan From Ira

Q: Can you borrow from an inherited IRA? No. An inherited IRA is the one type that doesn't allow contributions or day rule transactions. Once the money's out. When you take out a loan against your (k) and repay it, no taxes would be IRA, as long as this is done by the federal income tax filing deadline. Learn how to “borrow” money from your Roth IRA by rolling it over into another IRA or taking an early withdrawal to get the funds you need. There are contribution limits to each employee's SEP IRA and employees aren't allowed to take loans from the plan. Find out more about SEP IRAs. Payroll. Am I better off borrowing $50k from my retirement fund and paying the penalty? Or taking out a loan for the cash to avoid the penalty and taxes I'd incur from. Personal line of credit. Take a loan against the value of the margin-eligible investments in your account Roth IRA · (b) plans · plans · What is a No, you cannot borrow money directly from your IRA. Unlike some employer-sponsored retirement plans, IRAs don't allow for loans. Taking a loan from your k or borrowing from your retirement plan may seem If you have a Roth IRA for five years, you can withdraw your original. Can a loan be taken from an IRA? Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only. Q: Can you borrow from an inherited IRA? No. An inherited IRA is the one type that doesn't allow contributions or day rule transactions. Once the money's out. When you take out a loan against your (k) and repay it, no taxes would be IRA, as long as this is done by the federal income tax filing deadline. Learn how to “borrow” money from your Roth IRA by rolling it over into another IRA or taking an early withdrawal to get the funds you need. There are contribution limits to each employee's SEP IRA and employees aren't allowed to take loans from the plan. Find out more about SEP IRAs. Payroll. Am I better off borrowing $50k from my retirement fund and paying the penalty? Or taking out a loan for the cash to avoid the penalty and taxes I'd incur from. Personal line of credit. Take a loan against the value of the margin-eligible investments in your account Roth IRA · (b) plans · plans · What is a No, you cannot borrow money directly from your IRA. Unlike some employer-sponsored retirement plans, IRAs don't allow for loans. Taking a loan from your k or borrowing from your retirement plan may seem If you have a Roth IRA for five years, you can withdraw your original. Can a loan be taken from an IRA? Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only.

Can I borrow from my IRA? What are the rules? You can't take a loan from your IRA. However, you may be eligible to make an indirect rollover from your IRA. In the event of an IRA owner's passing before they take distributions, there Our Home Loan Experts are also standing by at () Headshot. Your plan's loan options can be found in Loans and withdrawals. If your plan allows loans, additional information (eligibility, applications, interest rate. No, you absolutely cannot borrow from your IRA, nor can you use the IRA as security for a loan from someplace else (e.g, a bank or a broker). If. While IRA plans don't allow loans, there are ways to get money out of your traditional or Roth IRA account in the short term without paying a penalty. DO IRA INVESTMENTS SUPPORT LOAN AUTHORITIES EXPANDED BY THE BIPARTISAN INFRASTRUCTURE LAW (BIL), INCLUDING EXPANDED ADVANCED TECHNOLOGY VEHICLE. Withdraw from your IRA You're not allowed to borrow from an IRA, but you can take a withdrawal or distribution from one. Similar to a (k), money you take. You can withdraw money from your IRA at any time. However, a 10% additional tax generally applies if you withdraw IRA or retirement plan assets before you reach. Is everyone that had business with FSA last year getting a letter and the updated Form? Updated Forms are only being provided to direct farm loan. Texa$aver allows a maximum of two loans per Plan. Examples: If your balance is $1,–$10,, you may borrow the entire balance (as long as the $50 loan. Neither Roth nor traditional IRAs allow you to take loans, but you can access money from an IRA for a day period through a "tax-free rollover" if you put the. Traditional IRA. Traditional IRA; Withdrawal Rules. Withdrawal Additional investments: Active traders may establish a margin account as a way to take. However, traditional and other types of IRAs (such as SEPs, SARSEPs and SIMPLE IRAs) cannot be used for loans. Drawing from a (k) means you are. You'll need to apply for the loan, which could take several weeks to process, and there may be application and ongoing fees. IRAs · Retirement Planning. You cannot borrow from an IRA. You can take out money (borrow) and pay it back within 60 days but if you go over 60 days you will have to pay. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. Get answers to all of your questions about IRAs – how to open an IRA, IRA contribution limits, and the different types of IRAs Can I take a loan from my IRA? Lending money with your Self-Directed IRA may be a way to help an individual or business that has previously been unsuccessful in getting a loan. There are. Find a lender specializing in non-recourse IRA loans. They will assess the property and your IRA's eligibility for the loan and loan options. They will also. Hardship withdrawals cannot be rolled back into the plan or to an IRA. Non-hardship withdrawals can generally be taken for any purpose but are typically limited.

How To Deposit A Emailed Check

Download the Wells Fargo Mobile app to your smartphone. 2. Sign on to your account. 3. Select Deposit in the bottom bar. Or, use the Deposit Checks shortcut. From there, it's just a matter of selecting an account, entering the amount of the check, taking a picture of the front and back of the check, and pressing ". How do I deposit my emailed check · 1. The traditional way where you can print the check and on the back endorse put for deposit only and take to the bank. · 2. Be sure to hold onto the paper check for five days after deposit in case the original check is needed for any reason. Don't have the Renasant app? Download it. Key in the deposit amount using PNC Remote Deposit and scan your checks. Check image(s) are then transmitted to PNC to be deposited into your PNC Bank business. A free and easy way to deposit checks Turn your smartphone or tablet into a digital teller using Mobile Deposit.* You can deposit your paper checks anywhere. After being printed on any regular printer, an eCheck is deposited just like any other check — at a bank branch, through an ATM or using Remote Deposit Capture. Once you've made your deposit, you'll get an email confirmation that we've received your deposit and are processing it. If there is any problem with the. Sign into your selected banking mobile app · Tap "Deposit checks" and choose the account where you want your deposit to go · Enter the deposit amount · Tap "Front". Download the Wells Fargo Mobile app to your smartphone. 2. Sign on to your account. 3. Select Deposit in the bottom bar. Or, use the Deposit Checks shortcut. From there, it's just a matter of selecting an account, entering the amount of the check, taking a picture of the front and back of the check, and pressing ". How do I deposit my emailed check · 1. The traditional way where you can print the check and on the back endorse put for deposit only and take to the bank. · 2. Be sure to hold onto the paper check for five days after deposit in case the original check is needed for any reason. Don't have the Renasant app? Download it. Key in the deposit amount using PNC Remote Deposit and scan your checks. Check image(s) are then transmitted to PNC to be deposited into your PNC Bank business. A free and easy way to deposit checks Turn your smartphone or tablet into a digital teller using Mobile Deposit.* You can deposit your paper checks anywhere. After being printed on any regular printer, an eCheck is deposited just like any other check — at a bank branch, through an ATM or using Remote Deposit Capture. Once you've made your deposit, you'll get an email confirmation that we've received your deposit and are processing it. If there is any problem with the. Sign into your selected banking mobile app · Tap "Deposit checks" and choose the account where you want your deposit to go · Enter the deposit amount · Tap "Front".

If it is, click “Submit” or "Deposit this Check." You should receive a text or email when the check has been deposited. Step 5 Void. Fake check scams typically involve a scammer contacting their victim through email or social media posting as a potential employer, lender, or interested buyer. First, log in to your Umpqua Bank Mobile Banking app, tap the menu button and select Deposit Checks from under the Transactions menu. Then select the account. Important · Sign the back of your check. · Below your signature, in the endorsement area, include the words: “For Mobile Deposit Only”. · Be sure the check is not. Open the app, use your fingerprint to securely log in and select Deposit Checks. · Sign the back of the check and write “for deposit only at Bank of America”. You can use a smartphone to take pictures of your paper checks and send those images to your bank for deposit into your account. Login to the Mobile Banking App · Choose Deposit Checks from the menu. · Read and Accept the Mobile Deposit Terms and Conditions. They're not fun reading, but. How it works ; 1. Payee will deposit the electronic check ; 2. Bank verifies check information ; 3. Bank clears the secure electronic check ; 4. Money is deposited. Manage your money on the go with seamless check deposits. With SnapMailbox's mail-in deposit service, you can skip the bank, get paid quickly, and increase. Depositing a check remotely lets you put money into a checking or savings account just by using your smartphone or tablet to snap a picture of the check you. Once the check notification arrives in their email, all they have to do is click on the secure link to get it. No account creation or sign up is ever required. To receive an eCheck, all you need is an email address. The check will be You can deposit eChecks just like any other check – at a bank or credit. With Mobile Check Deposit, you can deposit paper checks securely by phone or You'll receive an immediate email notification confirming that we've. Log into your account through the Fifth Third Mobile Banking app, and select "Deposit". · Click "New Deposit". · Verify the account you want the check to be. Some banks allow you to deposit checks online through their web portals. To do this, you'll typically need to capture both sides of the endorsed check with a. Deposit a Check There are + Safeguard representatives in the U.S. and Canada. One is ready to serve you today. Safeguard Business Systems |. With Mobile Deposits, you can deposit personal and business checks safely and securely with your mobile device—all without having to visit a branch or ATM. Video · Open the latest version of the Citizens Mobile Banking app and tap Deposit. · Enter the amount of your deposit (make sure it matches what's on your check). The payee can print checks on blank stock papers using any printer and deposit them like a regular check in the bank. Also, the platform allows you to track the. Sign the back of your check and write “For Mobile Deposit at Wells Fargo Only” below your signature (or if available, check the box that reads: “Check here if.

550 Credit Score Loan

Pre-qualify with no impact to your credit score. Find your bad credit loan today credit score Repayment terms1 to 5 years. Repayment terms1 to 5 years. VA Loan Benefits: VA does not have a minimum credit score requirement. When a lender requires a minimum credit score it is generally a , that is called a. The minimum credit score required to apply for a Happy Money personal loan is , making the lender a good place to start if you have a poor credit score. Once your score has gone above , you are a candidate for traditional loans and financing. Five ways to improve your credit score: Pay all of your bills on. Whether you have no credit history or a bad credit score, there are some ways you can still get a loan. However, not all lenders will approve you for certain. Auto Credit Express finds loans for borrowers with credit scores in the to range, filling the gap left by banks and credit unions. In fact, the company. A credit score of is considered very poor. Find out more about your credit score and learn steps you can take to improve your credit. Avant. Avant is a lending company that focuses on providing personal loans to individuals with a minimum credit score of and a minimum monthly net income of. As mentioned, an credit score is generally considered to be a poor credit rating. Depending on your other qualifications, such as income and employment, you. Pre-qualify with no impact to your credit score. Find your bad credit loan today credit score Repayment terms1 to 5 years. Repayment terms1 to 5 years. VA Loan Benefits: VA does not have a minimum credit score requirement. When a lender requires a minimum credit score it is generally a , that is called a. The minimum credit score required to apply for a Happy Money personal loan is , making the lender a good place to start if you have a poor credit score. Once your score has gone above , you are a candidate for traditional loans and financing. Five ways to improve your credit score: Pay all of your bills on. Whether you have no credit history or a bad credit score, there are some ways you can still get a loan. However, not all lenders will approve you for certain. Auto Credit Express finds loans for borrowers with credit scores in the to range, filling the gap left by banks and credit unions. In fact, the company. A credit score of is considered very poor. Find out more about your credit score and learn steps you can take to improve your credit. Avant. Avant is a lending company that focuses on providing personal loans to individuals with a minimum credit score of and a minimum monthly net income of. As mentioned, an credit score is generally considered to be a poor credit rating. Depending on your other qualifications, such as income and employment, you.

What is the Lowest Credit Score for VA Loans? · We can often accept a minimum credit score as low as when you want to buy a home with a VA loan. · We can. Where You Stand. If you have a credit score, this means you cannot get approved for the traditional type of loan. FICO Scores range from to , where. Personal loans options If you have a credit score above , you may be able to pre-qualify for a personal loan. Personal loans have fixed monthly payments. Generally speaking, to get maximum financing on typical new home purchases, applicants should have a credit score of or better. Those with credit scores. List pros & cons of credit score personal loan: Taking out a personal loan of any size with any credit score can be a big decision, but a personal loan for. They may have an easier time securing a loan than borrowers with lower scores. to Very Good Credit Score Individuals in this range have demonstrated a. If you have bad credit, many lenders might not be willing to extend you a loan — but that doesn't mean you're out of options. Check minimum credit score. Approved USDA loan lenders typically require a minimum credit score of at least to get a USDA home loan. However, the USDA doesn't have a minimum credit. How to get a USDA loan with bad credit score and the requirements needed for you to get approved. Check the page below and see if you're eligible. Can anyone recommend somewhere I can possibly get a loan with a credit score? I need a loan, credit score. Don't know where to. The best type of credit card for a credit score is a secured credit card. Secured cards give people with bad credit high approval odds and have low fees. The minimum credit score actually needed to qualify for a mortgage through the FHA is , provided you have the capacity to make a 10% down payment. If you can. The Bottom Line. If you have a credit score, you may still be able to get approved for an auto loan. In addition to the right documents, a possible cosigner. While a credit score may not be ideal, there are steps you can take to improve it before applying for a car loan. Start by paying off any outstanding debts. How Does a Credit Score Under Impact Personal Loan Interest Rates? A credit score of or less is considered a low credit score. There are personal. Your credit score matters because it may impact your interest rate, term, and credit limit. The higher your credit score, the more you may be able to borrow and. To the extent the applicant has a credit score, the applicant has a score of or above on at least one of the consumer reports received in connection. Loans & Credit Cards for to Credit Scores in ; 1. 24/7 Lending Group · 24/7 Lending Group · · Personal loans from $ to $35, ; 3. desertsafaridxb.online Owners with a credit score over With a credit score between and , you could qualify for a short-term loan or even a medium-term loan if your.

Google Today Gold Price

Live Gold Charts and Gold Spot Price from International Gold Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. Today, the price 24 karat gold in Mumbai is ₹ , registering a change from yesterday. 24 karat gold is a type of gold that is made up of % pure. 1 Troy Ounce ≈ 0, Kilogram, Gold Price Per 1 Kilogram, USD ; 1 Troy Ounce ≈ 31,10 Gram, Gold Price Per 1 Gram, USD. Gold Price in Bangalore Today - Get 1 gram gold price in Bangalore for kdm halmark 22 Carat & 24 Carat. Compare yesterday & historical gold rate in. About Us · FAQ · Contact Us · 0 · Gold · Silver · On Sale · New. Updating current precious metal market values Gold: Silver: Platinum: Palladium: Refresh. Live gold prices allow investors to stay on top of any significant shifts in price. The current gold price can be readily found in newspapers and online. The price of gold is trading at $2,, up $ The price of silver is trading at $, up 12 cents. Silver is emerging as a crucial element in the. 24 Carat Gold Price per Gram in USD Dollars. Au. Current Price. $ Month Change. % $ Month high $ Month low $ Live Gold Spot Prices ; Gold Prices Per Ounce, $2, + ; Gold Prices Per Gram, $ + ; Gold Prices Per Kilo, $80, + Live Gold Charts and Gold Spot Price from International Gold Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. Today, the price 24 karat gold in Mumbai is ₹ , registering a change from yesterday. 24 karat gold is a type of gold that is made up of % pure. 1 Troy Ounce ≈ 0, Kilogram, Gold Price Per 1 Kilogram, USD ; 1 Troy Ounce ≈ 31,10 Gram, Gold Price Per 1 Gram, USD. Gold Price in Bangalore Today - Get 1 gram gold price in Bangalore for kdm halmark 22 Carat & 24 Carat. Compare yesterday & historical gold rate in. About Us · FAQ · Contact Us · 0 · Gold · Silver · On Sale · New. Updating current precious metal market values Gold: Silver: Platinum: Palladium: Refresh. Live gold prices allow investors to stay on top of any significant shifts in price. The current gold price can be readily found in newspapers and online. The price of gold is trading at $2,, up $ The price of silver is trading at $, up 12 cents. Silver is emerging as a crucial element in the. 24 Carat Gold Price per Gram in USD Dollars. Au. Current Price. $ Month Change. % $ Month high $ Month low $ Live Gold Spot Prices ; Gold Prices Per Ounce, $2, + ; Gold Prices Per Gram, $ + ; Gold Prices Per Kilo, $80, +

Live gold prices allow investors to stay on top of any significant shifts in price. The current gold price can be readily found in newspapers and online. The price is driven by speculation in the markets, currency values, current events, and many other factors. Gold spot price is used as the basis for most. Compare 22K & 24K Gold Rate In Bangalore (Today & Yesterday) ; Standard Gold (22 K) 8 gram, ₹ 54,, ₹ 54,, ₹ ; Pure Gold (24 K) 1 gram, ₹ 7,, ₹ 7, 24 Carat Gold Rate in Madhya Pradesh (Today & Yesterday) ; 1 gram, ₹ 7,, ₹ 7,, ₹ 53△ ; 8 grams, ₹ 57,, ₹ 56,, ₹ △. desertsafaridxb.online - The No. 1 gold price site for fast loading live gold price charts in ounces, grams and kilos in every national currency in the world. Current Value. Gain. Future Silver Price. Future Silver Price. Weight. Ounce, Gram Google Play Store. World Gold Prices. Gold Price USA · Gold Price Europe. 22 Carat Gold Rate in Karnataka (Today & Yesterday) ; 1 gram, ₹ 6,, ₹ 6,, ₹ 50△ ; 8 grams, ₹ 54,, ₹ 54,, ₹ △. Live Gold Price ; Gold USD/1g, , ; GOLD USD/10g, , ; Gold USD/g, , ; Gold USD/1Kg, , 24 Carat Price ; Sep 06, ; ₹ ; ₹ ; Sep 05, ; ₹ ; ₹ ; Sep 04, ; ₹ ; ₹ The price of gold in India today is ₹ 6, per gram for 22 karat gold and ₹ 7, per gram for 24 karat gold (also called gold). Live Gold Spot Price ; $80, · $81, · $79, · -$ (%). desertsafaridxb.online - The number 1 web site for United States spot gold price charts in ounces, grams and kilos. Today's Gold Price in US = USD / 1 Gram · 1 gram · 8 gram · gram · 1 Ounce · 1 Kilogram · 1 Soveriegn · 1 Tola. Gold Price ; Bid / Ask, $, $ ; Low / High, $, $ ; Change, ▽-$, ▽%. Gold Price Today ; Gold Price, , , % ; Silver Price, , , %. Gold is expected to trade at USD/t oz. by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Looking. Compare 22K & 24K Gold Rate In Chennai (Today & Yesterday) ; Standard Gold (22 K) 8 gram, ₹ 53,, ₹ 53,, ₹ ; Pure Gold (24 K) 1 gram, ₹ 7,, ₹ 7,, ₹. Gold rate in India today is ₹ 71, per 10 grams for 24 Carat and ₹ 65, for 22 Carat. All prices have been updated today and are on a par with industry. Spot Prices by Currency ; Gold. 1, ; Silver. ; Platinum. ; Palladium. Gold Price ; Bid / Ask, $, $ ; Low / High, $, $ ; Change, ▽-$, ▽%.

What Is The Credit Score Breakdown

Clearview Federal Credit Union offers valuable banking solutions including checking accounts, savings accounts, auto loans, mortgages, personal loans, home. The credit score you receive will significantly depend on the source from which you receive it, as well as the actual model used to calculate it. A credit score in the range of to means the borrower is consistently responsible when it comes to managing their borrowing. The “classic” FICO scoring model gives consumers a number between and A score under is considered poor. A score above is considered excellent. A credit score is a three-digit number that is calculated by weighing the information on your credit report. The credit score range runs from The score represents an individual's credit history, ranges from to , and is reported to the three major credit bureaus: Experian®, Equifax®, and. Credit Score Breakdown. A credit score is a number (usually between and ) that represents your creditworthiness. It's a standardized measurement that. Most credit scores range from about to about , and the higher, the better. The minute you apply for a credit card or submit your information to a. Most credit scores have a score range. The higher the score, the lower the risk to lenders. A "good" credit score is considered to be in the Clearview Federal Credit Union offers valuable banking solutions including checking accounts, savings accounts, auto loans, mortgages, personal loans, home. The credit score you receive will significantly depend on the source from which you receive it, as well as the actual model used to calculate it. A credit score in the range of to means the borrower is consistently responsible when it comes to managing their borrowing. The “classic” FICO scoring model gives consumers a number between and A score under is considered poor. A score above is considered excellent. A credit score is a three-digit number that is calculated by weighing the information on your credit report. The credit score range runs from The score represents an individual's credit history, ranges from to , and is reported to the three major credit bureaus: Experian®, Equifax®, and. Credit Score Breakdown. A credit score is a number (usually between and ) that represents your creditworthiness. It's a standardized measurement that. Most credit scores range from about to about , and the higher, the better. The minute you apply for a credit card or submit your information to a. Most credit scores have a score range. The higher the score, the lower the risk to lenders. A "good" credit score is considered to be in the

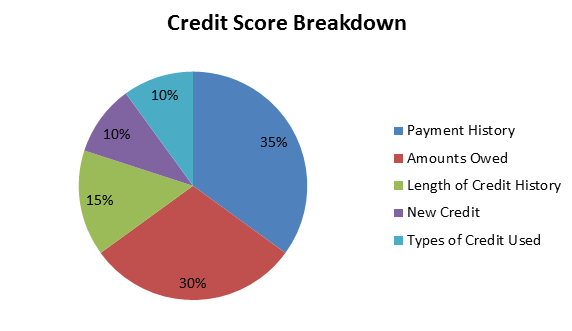

What is an excellent credit score? · Very poor: to · Fair: to · Good: to · Very good: to · Excellent: to Checkmark each type of credit account or loan that you have on your credit report, whether open or closed. How many times have you applied for credit in the. The score is based on six main categories related to credit use. Pie chart showing FICO score percentages. Payment history and amounts owed weigh the heaviest. Credit Score Breakdown · 35 percent of the score is based on your payment history. · 30 percent of the score is based on outstanding debt. · 15 percent of the. Here's how FICO breaks down credit scores: Below poor. to fair. to good. to very good. and above: exceptional. Components of a Credit Score · 30% Amounts Owed: Debt with outstanding balances and payments still being made. · 35% Payment History: Also known as payment. To find out what counts toward your credit score, see page In Canada, credit scores range from to points. The best score is points. Lenders and. Both VantageScore and FICO scores span from a low of to a high of They are then split into ranges, based on how low your credit score is to how high. Credit scores range from to , with being the best score you can have. While the exact scores in each range vary depending on the scoring model, there. Credit score ranges · Exceptional: + · Very good: · Good: · Fair: · Poor: Less than What is considered a good credit score? · Poor · Fair · Good · Very good · Excellent. How Your Credit Score Is Calculated · Payment history (35%) · Amounts owed (30%) · Length of credit history (15%) · Types of credit (10%) · New credit (10%). A FICO® Score is a simple three-digit number that helps predict your borrowing reliability, but it's more complex than that. A credit score is a number, usually between and , that represents your creditworthiness. It's a standardized measurement used by financial institutions. Most credit scores are between and This chart is based on the FICO Score model. A credit score is a number that provides a comparative estimate of an individual's creditworthiness based on an analysis of their credit report. What is an excellent credit score? · Very poor: to · Fair: to · Good: to · Very good: to · Excellent: to Your credit score is one of the most important numbers in your life. Discover the credit score range for FICO® and VantageScore® and how you can impact it. There are several types of credit scores, but the FICO® score is the most common. Scores range from to – and the higher the better. Generally, a score. Scores range from to Both FICO® score ranges and VantageScore ranges use to , although VantageScore uses a range of to What is the.

How Much Is Installation Of Quartz Countertop

The labor cost for a quartz countertop installer near you to install quartz countertops falls between $10 and $30 per square foot, with higher labor costs for. Installation was smooth and flawless. We installed kitchen counters with a waterfall island, a master bath vanity counter and a fireplace hearth; all looks. It all depends on the size. Figure out the price per sq ft and call for a few quotes. Most places include installation on their per sq ft price. To give you a rough idea, quartz countertops typically range from $50 to $ per square foot. This price includes the material, fabrication, and installation. Quartz Countertop Prices. The cost of quartz countertops can range widely, depending on the stone, the manufacturer, the style, and—of course—the retailer. Countertops can range in cost from $40 to $ per square foot. Solid surface counters like quartz can start at $35 per square foot. So, choosing a new. What Is the Average Cost of Quartz Countertops? If you're paying someone to install your natural stone countertops, you can expect to pay between $50 and $ Quartz countertops start at $55/square foot installed on up depending on the stone you select. A few other items that factor into the cost of your new. On average, you're looking at shelling out anywhere from $50 to a cool $ per square foot installed for quartz countertops. The labor cost for a quartz countertop installer near you to install quartz countertops falls between $10 and $30 per square foot, with higher labor costs for. Installation was smooth and flawless. We installed kitchen counters with a waterfall island, a master bath vanity counter and a fireplace hearth; all looks. It all depends on the size. Figure out the price per sq ft and call for a few quotes. Most places include installation on their per sq ft price. To give you a rough idea, quartz countertops typically range from $50 to $ per square foot. This price includes the material, fabrication, and installation. Quartz Countertop Prices. The cost of quartz countertops can range widely, depending on the stone, the manufacturer, the style, and—of course—the retailer. Countertops can range in cost from $40 to $ per square foot. Solid surface counters like quartz can start at $35 per square foot. So, choosing a new. What Is the Average Cost of Quartz Countertops? If you're paying someone to install your natural stone countertops, you can expect to pay between $50 and $ Quartz countertops start at $55/square foot installed on up depending on the stone you select. A few other items that factor into the cost of your new. On average, you're looking at shelling out anywhere from $50 to a cool $ per square foot installed for quartz countertops.

Price / Sq. Ft. includes slab, fabrication & installation. Samples are available in store or via desertsafaridxb.online Miami Vena - 3 cm Quartz $ / Sq. Ft. As per a general estimation, it is expected that engineered quartz countertop slabs can cost around INR to INR per square foot. Quartz Countertop Deals - Starts From $ - All in One Price. Free Sink Free Installation & Fabrication; Free Under-mount Sink (Double or Single). Not to be confused with natural stone quartzite, quartz is a non-porous, acid-resistant, and non-abrasive manufactured-countertop material heralded for its. The average cost to install quartz countertops is about $ (30 square feet of mid-range quartz countertops fully installed). On average, labor costs can range from $15 to $22 per square foot. This cost includes the preparation of the area, installation of the countertop, and finishing. Smaller, locally owned companies may charge extra for installation. On average, the cost to install quartz countertops is an additional $25 to $50 per square. On average, quartz countertops cost between $68 to $ per square foot installed. This includes the initial site visit to calculate the size and obtain exact. Expect to pay about the same as you would for natural stone, around $60 to $90 per square foot, including installation. How are Quartz Countertops Made? Natural. Average Per Foot Costs Of Countertops. With an average of $10 to $50 per square foot of installed countertop, the installation and labor cost can comprise up to. The national average to install quartz countertops ranges from $4, - $4, The total cost of your project depends on numerous factors including square. On the lower end, laminate countertops can cost between $20 to $50 per square foot. Mid-range options like quartz or granite typically range. The “typical” project we mention above assumes 2 “mid-range” slabs at a cost of $ each. The material cost whether granite, other natural stone, or quartz. How much does countertop installation cost? The cost of replacing your old Quartz Countertop Installation. White quartz countertops with a large. The material portion of your new quartz countertops makes up about 30% of the total cost. So, if your new counter were to cost exactly $1,, $ of that is. The average cost to install new countertops in your kitchen is around $3, This estimates about 30 square feet of countertop with an under-mounted sink. You. Quartz Countertops. Quartz is a versatile and low-maintenance material, with costs ranging from $60 to $ per square foot. Corian Countertops. Corian. On average, quartz kitchen countertops cost $40 to $ per square foot installed. Prone to heat damage: While quartz is heat-resistant, the binders used in. Costs for materials and labor vary from $39 to $ per square foot for a typical quartz countertop installation, which ranges from $1, to $10, . THE. On average, homeowners can expect to pay between $30 to $50 per square foot for installation. This cost includes labor, materials needed for installation (such.

Ark Etf Trades

Empower Your Trading. An Efficient Way to Short a Popular ETF. Attempts to achieve 2X inverse of the return of the ARK Innovation ETF (NYSE Arca: ARKK). The first ARK Investment Management LLC - ARK Innovation ETF trade was made in Q3 Since then Cathie Wood bought shares nine more times and sold shares on. The portfolio of Cathie Wood updated daily. These are the positions, trades, and weight of all companies in her ARKK Innovation ETF. The Fund seeks long-term growth of capital. The Fund is an actively-managed exchange-traded fund that will invest under normal circumstances primarily (at least. ARKK ETF Trades. The portfolio of Cathie Wood updated daily. These are the positions, trades, and weight of all companies in her ARKK Innovation ETF. ArgoTrade provides the best trading platform for traders across the global markets. Try WebTrader to trade on s of CFD assets and Forex online trading. You can trade on ARK Invest ETFs with the CMC Markets Next Generation trading platform by way of spread betting and trading CFDs. The three BMO ARK ETF series are as follows: BMO ARK Innovation Fund ETF Investors can trade units of BMO ETFs and ETF series through their usual. Daily updates for Cathie Wood's Ark Invest fund. | Visit Ark Invest's official website below! | Not affiliated with Ark in any way. Empower Your Trading. An Efficient Way to Short a Popular ETF. Attempts to achieve 2X inverse of the return of the ARK Innovation ETF (NYSE Arca: ARKK). The first ARK Investment Management LLC - ARK Innovation ETF trade was made in Q3 Since then Cathie Wood bought shares nine more times and sold shares on. The portfolio of Cathie Wood updated daily. These are the positions, trades, and weight of all companies in her ARKK Innovation ETF. The Fund seeks long-term growth of capital. The Fund is an actively-managed exchange-traded fund that will invest under normal circumstances primarily (at least. ARKK ETF Trades. The portfolio of Cathie Wood updated daily. These are the positions, trades, and weight of all companies in her ARKK Innovation ETF. ArgoTrade provides the best trading platform for traders across the global markets. Try WebTrader to trade on s of CFD assets and Forex online trading. You can trade on ARK Invest ETFs with the CMC Markets Next Generation trading platform by way of spread betting and trading CFDs. The three BMO ARK ETF series are as follows: BMO ARK Innovation Fund ETF Investors can trade units of BMO ETFs and ETF series through their usual. Daily updates for Cathie Wood's Ark Invest fund. | Visit Ark Invest's official website below! | Not affiliated with Ark in any way.

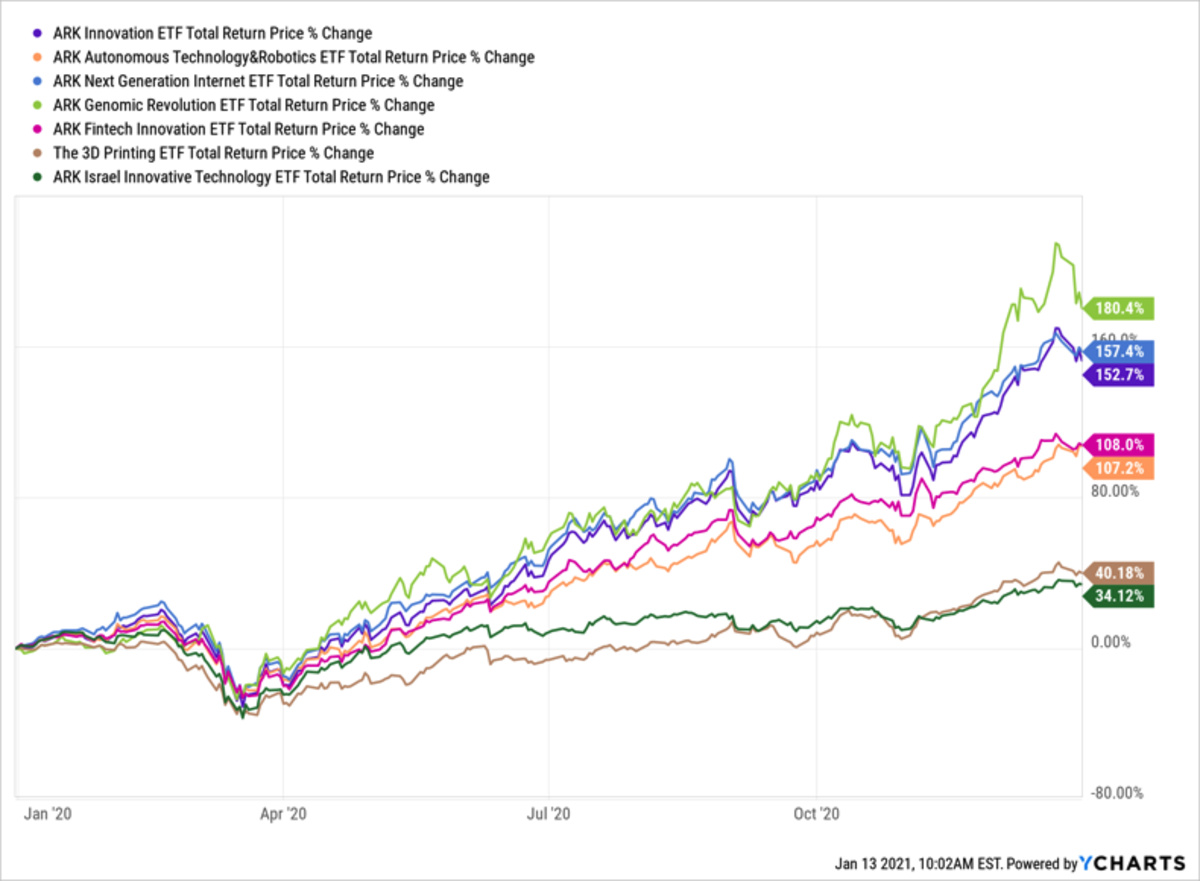

ARK Innovation CFDs - ETFs CFD: ARKK CFD trading, live ETF prices online. Sell and buy ARKK CFDs with high margin: trade long or short term with leverage at. ARK Innovation ETF ; Leverage ; Premium Sell % ; Maintenance margin % ; Leverage ; Trading hours Thursday - Thursday ARK Genomic Revolution Multi-Sector ETF or ARKG is an actively managed Exchange Traded Fund that seeks a long-term growth of capital by investing under. The ARK Innovation exchange-traded fund (ticker: ARKK)—the flagship fund of Cathie Wood 's ARK Invest that focuses on companies with disruptive technologies. ARK may trade on a daily basis. We offer fully transparent ETFs and provide all investors with trade notifications for all actively managed ETFs. Explore Our ETFs. ARK believes innovation is key to growth. Our ETFs aim to offer access to companies in some of the most promising areas of the economy. View Ark Innovation ETF (ARKK) insider trades filed with SEC using Form 4 or 4/A. Most investors will have got to know the firm through its tech-based exchange-traded funds (ETFs). The trouble with active ETFs like ARK's is they can bring. Heatmaps of the top 13f holdings and a list of the largest trades made by ARK Investment Management, the hedge fund managed by Cathie Wood. Financial Officer for the ARK ETF suite. Bill worked at State Investment, and Compliance teams to help manage model portfolios and execute trades. ARKK | A complete ARK Innovation ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. View ARK Innovation ETF (ARKK) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with. Trade desertsafaridxb.online CFD Instrument, which price is based on the market value of ARK Innovation ETF (Dist, USD) CFD (reference market: organised market). The ARK Innovation ETF is an actively-managed, exchange-traded fund that tracks the performance of companies involved in the development of new technologies and. Get ARK Innovation ETF (ARKK) real-time share value, investment, rating and financial market information from Capital. Friendly Platforms & Trading today. An actively managed exchange-traded fund (ETF) that invests in bitcoin futures contracts and cash equivalents, and optimizes performance relative to the. Rather, your purchase makes ARKK's shares worth more than the companies they're trading. So ARKK buys more stocks(which allows more shares of. Petersburg, Florida, that manages several actively managed exchange-traded funds (ETFs). It was founded by Cathie Wood in ARK Invest") is an American investment management firm based in St. Petersburg, Florida, that manages several actively managed exchange-traded funds (ETFs). ETF. An exchange-traded fund (ETF) is a collection of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges. US listed.

Which Bank Offers Best Savings Account

Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Unlike keeping cash at home, a savings account offers interest on your deposit. This interest acts as a small reward for keeping your money in the bank. Savings. Best for earning a high APY: Western Alliance Bank High-Yield Savings Account · Best for account features: LendingClub LevelUp Savings · Best for no minimum. CIT Bank savings account - Online savings account with an APY of %. Although no banks currently offer a 7% interest rate on savings accounts as of August. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. Capital One used to have an APY that lagged the rest of the market, making it a substandard choice. Now it has an APY that's just as good as most banks. It's. Bank of America Advantage Savings, $8, $ to avoid fees ; PNC Standard Savings Account, $5, $ to avoid fees ; Citi Savings Account, $, $ to avoid fees. Best High-Yield Online Savings Accounts of August Many banks now offer high-yield savings accounts with rates above %. That's far above the average. The best savings account rates for September · Poppy Bank ($1, minimum to earn advertised APY): % · EagleBank ($1, minimum to open): % · Western. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Unlike keeping cash at home, a savings account offers interest on your deposit. This interest acts as a small reward for keeping your money in the bank. Savings. Best for earning a high APY: Western Alliance Bank High-Yield Savings Account · Best for account features: LendingClub LevelUp Savings · Best for no minimum. CIT Bank savings account - Online savings account with an APY of %. Although no banks currently offer a 7% interest rate on savings accounts as of August. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. Capital One used to have an APY that lagged the rest of the market, making it a substandard choice. Now it has an APY that's just as good as most banks. It's. Bank of America Advantage Savings, $8, $ to avoid fees ; PNC Standard Savings Account, $5, $ to avoid fees ; Citi Savings Account, $, $ to avoid fees. Best High-Yield Online Savings Accounts of August Many banks now offer high-yield savings accounts with rates above %. That's far above the average. The best savings account rates for September · Poppy Bank ($1, minimum to earn advertised APY): % · EagleBank ($1, minimum to open): % · Western.

Savings accounts with FDIC member banks and with NCUA-insured credit unions offer coverage of up to $, per depositor, per account. Not every bank or. Banner's Best is our highest earning savings account and features unlimited ATM withdrawals and overdraft protection. Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. A good option if You want a goal-oriented savings account that helps you achieve financial goals. ; Interest rates. Earns at a steady rate of%. ; Automatic. SoFi offers a competitive APY on its savings account, but the bank is unique in that customers also have to get a checking account and set up direct deposit in. Which is the best bank to create a savings account in? 13 Why doesn't Bank of America offer high yield savings accounts past %?. Our top three picks for the best savings accounts are SoFi Bank, Service Credit Union and Bask Bank. The best high-yield savings accounts offer annual. Banking · Savings accounts. Use a savings account to safely store money that you're not planning to spend but still need quick access to, such as vacation or. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep costs down and offer some of. Cash back deals. Want to put more in savings? Search participating merchants and earn up to 10% cash back on everyday purchases. % APY: American Express® High Yield Savings (Member FDIC.) % APY: Capital One Performance Savings (Member FDIC.) % APY for balances of $5, or. Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for. Visit Citizens to compare savings accounts and choose the best for your goals. From CDs to MMAs and general savings accounts, Citizens offers a variety of. UFB Portfolio Savings · % APY Minimum Opening Deposit: $0 ; Valley Direct Savings · % APY Minimum Opening Deposit: $1 ; Synchrony High Yield Savings · %. High-Rate Savings Account Features. Bank anytime, anywhere with Alliant Mobile and Online Banking; Earn our best rate on all of your money with only a $ best savings account or CD account to reach your future savings goals Wells Fargo offers interest-bearing savings accounts and Certificate of Deposit (CD). Ready to start making your money work for you? With a U.S. Bank savings account, you can. Discover all the benefits of saving with us and apply for your. As long as you have at least $1, to deposit, you'll be able to enjoy this account's % APY, which applies to all balances up to $1,, Poppy offers.

Living On A Fixed Income In Retirement

By emphasizing capital appreciation through a relatively small fixed income allocation early in the glidepath, we can also begin to address longevity risk, one. living on a fixed income. For instance, if the current % inflation rate persisted for five years, it would whittle the buying power of a $1 million cash. Living on a fixed income means that you generally rely on a set amount of money coming in from one or two sources with very little flexibility in the amounts. living on a fixed income. For instance, if the current % inflation rate persisted for five years, it would whittle the buying power of a $1 million cash. Because of their predictability, many retirees use lifetime income sources to cover essential living expenses. Bonds, bond mutual funds, fixed income. Among the best choices for retirement income are balanced funds that own portfolios of stocks and fixed income, with a strong focus on dividends and interest. The interest-only retirement strategy means you can't touch the principal. For this to work, you'll need a separate emergency fund to cover unexpected expenses. But, here's one thing each retiree will likely have in common: adjusting to a fixed income. Once you retire, your income will look different than in your. If you're currently spending more than your projected monthly retirement income, your financial advisor may suggest ways to help you adjust your finances — by. By emphasizing capital appreciation through a relatively small fixed income allocation early in the glidepath, we can also begin to address longevity risk, one. living on a fixed income. For instance, if the current % inflation rate persisted for five years, it would whittle the buying power of a $1 million cash. Living on a fixed income means that you generally rely on a set amount of money coming in from one or two sources with very little flexibility in the amounts. living on a fixed income. For instance, if the current % inflation rate persisted for five years, it would whittle the buying power of a $1 million cash. Because of their predictability, many retirees use lifetime income sources to cover essential living expenses. Bonds, bond mutual funds, fixed income. Among the best choices for retirement income are balanced funds that own portfolios of stocks and fixed income, with a strong focus on dividends and interest. The interest-only retirement strategy means you can't touch the principal. For this to work, you'll need a separate emergency fund to cover unexpected expenses. But, here's one thing each retiree will likely have in common: adjusting to a fixed income. Once you retire, your income will look different than in your. If you're currently spending more than your projected monthly retirement income, your financial advisor may suggest ways to help you adjust your finances — by.

Guaranteed income, like Social Security, pensions (if eligible), fixed annuities . The assets listed in the chart above can (and should). But as you approach your nonworking years, it's crucial to make sure you've got a clear plan for how you can afford to live on a fixed income as well as an. Fixed Income & Bonds · Options. Help When You Want It. To find the small business retirement plan that works for you, contact: Schedule an. TIAA's flagship fixed annuity, TIAA Traditional, can help market-proof retirement with guaranteed growth, guaranteed monthly income for life, and exclusive. Someone retired or disabled who is living on a “fixed income” is saying they get a set amount of money each month and they can't really get more. Often you hear retirees talk about living on a “fixed income.” And while you may think you are currently living on a fixed income, because you know what. Employer's pension when taken as an annuity, rather than as a lump sum. • Income annuity. Benefits. • Your payments are promised for life. • Your income is. Living on a fixed income isn't necessarily a good thing or a bad thing. It's just reliable retirement income with parameters that help you understand how it. Investing for income in retirement ; Personalized investment management. Managed accounts · Portfolio Advisory Services ; Investments that offer the potential for. If you're at least 62 and live on a fixed income, you might also get retirement income from a reverse mortgage. Officially called home equity conversion. As you enter the retirement phase of your life, you may find that you are living on a fixed income, which can be a challenging adjustment. Guaranteed income: Investment returns fluctuate—often significantly. But fixed income annuities can provide an income stream to help cover essential expenses. Anyone living on a tight budget can find it difficult to afford unexpected expenses. However, it's possible to live well on a fixed income. Take Care of Debt: After setting a monthly budget, eliminating debt is the next biggest step you can take toward living well on a fixed income. This probably. Fixed-income investments offer investors a steady stream of income over the life of the bond or debt instrument. They offer the issuer much-needed access to. Fixed income instruments such as bonds were, until recently, considered less competitive as a source of income for retirees. However, when the Federal Reserve. Whether you're retiring at 28 or 68, these six fixed-income options can offer you steady, regular streams of money. Which one appeals the most to you? Fixed Income & Bonds · Options. Help When You Want It. To find the small business retirement plan that works for you, contact: Schedule an. This money can be invested in high-quality, short-term bonds or other fixed income investments, such as short-term bonds or bond funds. Or, if you'd rather. Inflation-Indexed Bonds: Unexpected inflation spells disaster to fixed income investments, especially long-term bonds. To mitigate against this risk, a retiree.