desertsafaridxb.online

Prices

How To Invest For Short Term Goals

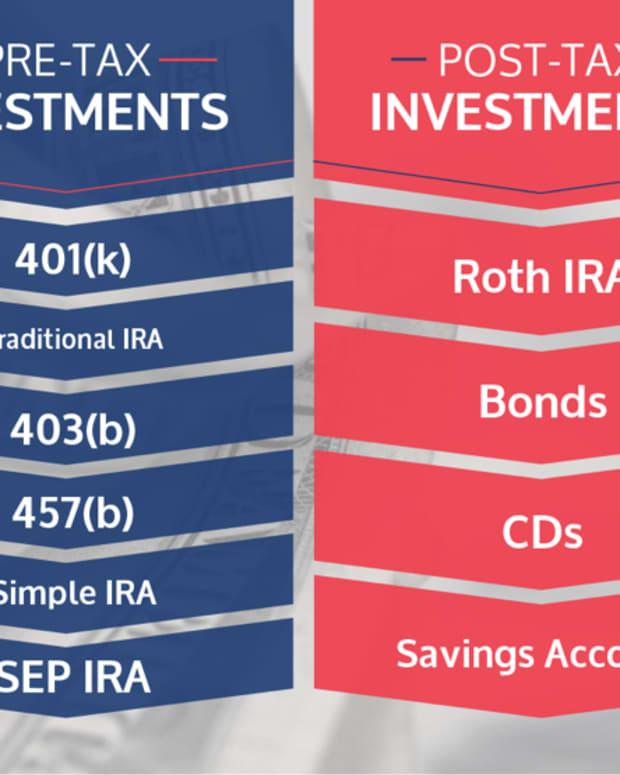

How much does it cost to invest in Vanguard money market funds? Each of our mutual funds has an expense ratio—a built-in cost for running the fund. The annual. “When deciding whether to save or invest your money, it is essential to prioritize determining when you will need it,” says Maizes. “For shorter-term goals, it. 8 Best Short-Term Investments in September · 2. Cash management accounts · 3. Money market accounts · 4. Short-term corporate bond funds · 5. Short-term U.S. 2. Fixed deposits. Fixed deposits are easily among the best options for short-term investments. They offer a high rate of return, independence from market. Some key short-term goals include setting a budget, starting an emergency fund, and paying off debt. From there, you may want to start saving for things you. If you're looking to save for short-term goals, such as paying for a wedding or home improvement, there are many great options, including savings accounts and. Keep cash for goals you want to achieve within the next two years in a low-risk account, such as a high-yield savings account that earns at least 3% interest. Best Short-Term Investment Options for 3 Months · Recurring Deposits · Bank Fixed Deposits · Treasury Securities · Money Market Account · Stock Market /Derivatives. Savings and Money Market Accounts. These are the most common types of short-term investment plans. Depositing money into these accounts earns interest over time. How much does it cost to invest in Vanguard money market funds? Each of our mutual funds has an expense ratio—a built-in cost for running the fund. The annual. “When deciding whether to save or invest your money, it is essential to prioritize determining when you will need it,” says Maizes. “For shorter-term goals, it. 8 Best Short-Term Investments in September · 2. Cash management accounts · 3. Money market accounts · 4. Short-term corporate bond funds · 5. Short-term U.S. 2. Fixed deposits. Fixed deposits are easily among the best options for short-term investments. They offer a high rate of return, independence from market. Some key short-term goals include setting a budget, starting an emergency fund, and paying off debt. From there, you may want to start saving for things you. If you're looking to save for short-term goals, such as paying for a wedding or home improvement, there are many great options, including savings accounts and. Keep cash for goals you want to achieve within the next two years in a low-risk account, such as a high-yield savings account that earns at least 3% interest. Best Short-Term Investment Options for 3 Months · Recurring Deposits · Bank Fixed Deposits · Treasury Securities · Money Market Account · Stock Market /Derivatives. Savings and Money Market Accounts. These are the most common types of short-term investment plans. Depositing money into these accounts earns interest over time.

1. Match your investments to your goals. Know your goals, your time frame for achieving them, and how much risk you're willing to take as an investor. Some tips for setting investment goals · Prioritize your goals and allocate money accordingly. · Consider your risk tolerance for each goal. · Start as early as. Saving vs. Investing · Saving. For the short term. Typically for smaller, shorter-term goals in the near future like saving for a large purchase or for an. long time in investments that pay a low amount of interest. On the other hand, if you are saving for a short-term goal, five years or less, you don't want. To determine a good savings goal, factor in your income, expenses and the timeline to reach your goals. Then set up a budget and leverage financial tools. With a less time to recover from market declines, consider traditionally more stable investments, such as cash, money market funds, short-term Treasury bills. Once you've assessed your financial situation, it's time to define your investing goals. For most investors, saving for retirement is a primary goal. Other. Invest for short- and intermediate-term goals. For goals that are close at hand, how do you balance loss aversion with return potential? 1. Match your investments to your goals. Know your goals, your time frame for achieving them, and how much risk you're willing to take as an investor. Determine your goals; Choose an account type based on your goals; Align your goals with your risk tolerance and time horizon; Stay diversified; Start investing. This blog explains how to put together an investment plan for managing money over short periods. We look at what kind of investment instruments are suitable. 2. Consider short-term instruments · 3. Synchronize goal timing with your assets · Make sure your investment strategy works for you. Once your plan has been. They are typically suitable for needs or goals that are more immediate or in the near future — for example, saving for the purchase of a vehicle. If an investor. When choosing how to invest your money, it's best to have an idea of what your investment goals are. One aspect you might consider is whether you are. On the other hand, investing solely in cash investments may be appropriate for short-term financial goals. The principal concern for individuals investing. Investment goals provide structure and purpose to the money we allocate to investment products, such as stocks, bonds and funds. Investing and investment goal. No matter what your life goals are, ensure you set a timeline to achieve each of them, then, choose an investment strategy that meets your unique requirements. Once you have saved money to meet emergency needs, consider investing other savings to grow your money. Think about your short and long-term goals. It is. Some short-term investment options include savings accounts, money market accounts, CDs, and short-term bond funds. Best Short-Term Investment Options for 3 Months · Recurring Deposits · Bank Fixed Deposits · Treasury Securities · Money Market Account · Stock Market /Derivatives.

What Are The Best Solar Panels For Home Use

What type of solar panel is best? · Monocrystalline panels are the most efficient of the crystalline solar panels at % efficiency. · Polycrystalline panels. Unbound Solar stocks and delivers a complete solar power system for homes, businesses, boats and RVs, remote industrial and unique applications to utilize solar. Buying a solar energy system will likely increase your home's value. A recent study found that solar panels are viewed as upgrades, just like a renovated. The Leading solar panels overall · Panasonic, LG, and SunPower are among the top premium panel manufacturers. · Canadian Solar and Trina Solar are two of the best. Everything you need to consider when choosing solar panels – from what type of homes are suitable to which brands have the best solar panels. 4 articles. Solar panels convert sunshine into renewable electricity. They come in all shapes and sizes, from durable thin-film solar panels to rigid aluminium-framed. Qcells secures the top spot in our rankings of the best solar panels for good reason. The cutting-edge desertsafaridxb.online panels stand out as the brand's highest-. Best solar panels for efficiency ; SunPower, X-series, Up to % ; Panasonic, EverVolt® Photovoltaic series, Up to % ; SunPower, M-series, Up to 22% ; REC. What's the Best Solar Panels and the Best Solar Company? Discussion on creating heat and hot water with solar for residential and commercial use. What type of solar panel is best? · Monocrystalline panels are the most efficient of the crystalline solar panels at % efficiency. · Polycrystalline panels. Unbound Solar stocks and delivers a complete solar power system for homes, businesses, boats and RVs, remote industrial and unique applications to utilize solar. Buying a solar energy system will likely increase your home's value. A recent study found that solar panels are viewed as upgrades, just like a renovated. The Leading solar panels overall · Panasonic, LG, and SunPower are among the top premium panel manufacturers. · Canadian Solar and Trina Solar are two of the best. Everything you need to consider when choosing solar panels – from what type of homes are suitable to which brands have the best solar panels. 4 articles. Solar panels convert sunshine into renewable electricity. They come in all shapes and sizes, from durable thin-film solar panels to rigid aluminium-framed. Qcells secures the top spot in our rankings of the best solar panels for good reason. The cutting-edge desertsafaridxb.online panels stand out as the brand's highest-. Best solar panels for efficiency ; SunPower, X-series, Up to % ; Panasonic, EverVolt® Photovoltaic series, Up to % ; SunPower, M-series, Up to 22% ; REC. What's the Best Solar Panels and the Best Solar Company? Discussion on creating heat and hot water with solar for residential and commercial use.

Q-Cells Watt Solar Panel · Canadian Solar Watt Panels · Panasonic Solar Panels · Trina Watt Panel. To see if your house is a good candidate for solar, try out a solar panel suitability checker such as Google's Project Sunroof. Then set up an appointment. Monocrystalline module by loom solar is the best Solar panels for home in India. This is the A-grade module from the Loom solar in the market to target specific. Solar Panel Efficiency High-efficiency panels optimally convert sunlight into electricity, delivering a more effective and sustainable solar solution for your. Best Solar Panels for Your Home ; Best Overall: Aiko N-Type ABC White Hole (72 Cells) ; Best Budget: Canadian Solar HiHero ; Best Splurge: SunPower M-Series ; Best. Solar performs best on homes with high electricity bills because each kilowatt-hour (kWh) they offset is worth more — so assessing your energy consumption is. Hanwha Q Cells is a global solar energy company that produces several types of solar panels, including those for commercial use. They are known for their high-. Monocrystalline panels have an overall darker tint to the cells and are typically the more efficient option. Panels with a higher efficiency mean you can. Solar Panel Efficiency High-efficiency panels optimally convert sunlight into electricity, delivering a more effective and sustainable solar solution for your. *Vivint solar panels meet or exceed industry solar panel lifespan standards and offer industry-leading production guarantees. *For more information on solar. Our top recommendations for residential solar customers are the panels from SunPower/Maxeon. This manufacturer has a long history in the solar industry and is. Maxeon's SunPower Residential AC W residential model takes first place as the most efficient residential home solar panel. Maxeon has been using the same. Monocrystalline solar panels are the most common and efficient type of solar panel available. Due to the silicon's high purity, these panels excel at producing. With a trifecta of power, efficiency, and longevity, the N-Type ABC White Hole is the best overall solar panel on our list. One small drawback is that the price. A solar system may provide a good hedge against rising electricity prices, which rose an average of % from to , according to the U.S. Energy. Most solar photovoltaics clock in around 18% efficiency at converting sunlight into electricity. The next generation of 'perovskite enhanced' PV. Qcells secures the top spot in our rankings of the best solar panels for good reason. The cutting-edge desertsafaridxb.online panels stand out as the brand's highest-. You can use a solar panel system even if you don't live in these blue-sky states. Most solar panel installers use photovoltaic (PV) panels, which can absorb. Reduced utility costs: The costs of electricity with solar systems tend to be lower than those of traditional utilities. These systems also provide homeowners. You can use a solar panel system even if you don't live in these blue-sky states. Most solar panel installers use photovoltaic (PV) panels, which can absorb.

When To Invest In Roth Ira

A Roth IRA is just an account to hold your money, but once money is in the account, it's up to you to place trades to invest the money. You can. What are the key features of a Roth IRA? · Means you pay no taxes on your investment earnings, as long as you follow the Roth IRA rules. · Provides access to a. Always invest your contributions immediately. Also, "low risk" is not your goal in a Roth IRA at age FXAIX is the S&P index fund. It's. With a Roth IRA at Betterment, you get the technology, tools, and tax breaks to help you save for retirement while saving on taxes. As such, there are two primary reasons why a Roth IRA is a great starter investment for teens and young adults: Taxes and the power of compound growth. A. At age 59 ½, investment earnings can be withdrawn without taxes or penalties if the Roth IRA account has been open for a minimum of five years. Earnings. Unlike Traditional IRAs, Roth IRAs (unless inherited) don't require you to take minimum distributions starting at age And similar to a Traditional IRA, you. In a lower tax bracket · Wanting more spendable income · Ready to invest at least $1, · Needing flexibility · Nearing retirement · Not sure which IRA is right for. You can contribute to a Roth IRA at any age. As a result of changes made by the SECURE Act, you can make contributions to a traditional IRA for or later. A Roth IRA is just an account to hold your money, but once money is in the account, it's up to you to place trades to invest the money. You can. What are the key features of a Roth IRA? · Means you pay no taxes on your investment earnings, as long as you follow the Roth IRA rules. · Provides access to a. Always invest your contributions immediately. Also, "low risk" is not your goal in a Roth IRA at age FXAIX is the S&P index fund. It's. With a Roth IRA at Betterment, you get the technology, tools, and tax breaks to help you save for retirement while saving on taxes. As such, there are two primary reasons why a Roth IRA is a great starter investment for teens and young adults: Taxes and the power of compound growth. A. At age 59 ½, investment earnings can be withdrawn without taxes or penalties if the Roth IRA account has been open for a minimum of five years. Earnings. Unlike Traditional IRAs, Roth IRAs (unless inherited) don't require you to take minimum distributions starting at age And similar to a Traditional IRA, you. In a lower tax bracket · Wanting more spendable income · Ready to invest at least $1, · Needing flexibility · Nearing retirement · Not sure which IRA is right for. You can contribute to a Roth IRA at any age. As a result of changes made by the SECURE Act, you can make contributions to a traditional IRA for or later.

You can establish a Roth IRA anytime during the calendar tax year or through the tax deadline for that year. You must make all contributions for the year by the. Select from a wide array of stocks, bonds, options, ETFs, well-known mutual funds and managed portfolios. You may also consider investing in a Money Market IRA. Roth IRAs offer tax-free growth potential. Investment earnings are distributed tax-free when the account has been funded for more than five years and you are at. You can establish a Roth IRA anytime during the calendar tax year or through the tax deadline for that year. You must make all contributions for the year by the. A general guideline is that if you think your tax bracket will be higher when you retire than it is today, you may want to consider a Roth IRA—especially if you. Make up for lost time and boost your tax-free retirement savings. If you ever thought about opening a Roth IRA but didn't last year, you may still be able to. Roth IRA contributions and limits. In , you can contribute up to $6, to a Roth IRA (or $7, if you'll be at least age 50 by year end. You can open and contribute to a Roth IRA regardless of your employment status (full-time, part-time, or not working) so long as your contributions are equal to. By investing in a Roth IRA, you won't pay taxes on potential earnings and can enjoy the freedom of withdrawing your money in retirement without worrying about. Sometimes referred to as the Roth “five-year rule,” it limits your flexibility in using earnings from your Roth IRA until five years after your first. Generally speaking, most investors should consider having a Roth IRA as part of their overall retirement plan because it offers federal tax-free growth. You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can make contributions to your Roth. 1. S&P index funds. One of the best places to begin investing your Roth IRA is with a fund based on the Standard & Poor's Index. You can contribute to a Roth IRA at any age if you have earned income (earnings from employment, including self-employment or alimony, not investment or rental. Retirement saving is one of the most important financial decisions that one can make. IRAs are a standard retirement account that provides life long savings. A Roth Individual Retirement Account, or Roth IRA, is an investment account that helps you save for retirement and reduce taxes. Roth-iras Tax-free income is the dream of every taxpayer. And if you save in a Roth IRA account, it's a reality. These accounts offer big benefits, but the. While traditional IRAs may provide immediate tax breaks because they're deductible and funded with pre-tax money, Roth IRA benefits happen on the back end, as. The Roth Vs Traditional bit is really a question for your financial advisor. There is no correct answer as it depends on income, tax situation, and so on. Are there any investment deadlines? Yes. You can contribute to a Roth IRA for a specific tax year starting January 1 of that year and you must make all.

Rolled Ice Cream Maker Amazon

Versatile Ice Cream Maker: Enjoy endless possibilities with our ice cream maker machine. Make delicious ice cream, sorbet, gelato, and even rolled ice cream. VEVOR Fried Ice Cream Roll Machine Single Pan Commercial Ice Roll Maker Ice Cream Pan Fried Yogurt Cream Machine for Bars/Cafes/Dessert Shops. Q: How. This versatile machine allows you to create a variety of frozen treats with ease. Simply adjust the temperature and mix settings to achieve the perfect. About this item · FAMILY TIME: INMAKER rolled ice cream maker inspire your creativity, as you can match exclusive ingredients to your diet to satisfy your need. VEVOR Fried Ice Cream Roll Machine Single Pan Commercial Ice Roll Maker Ice Cream Pan Fried Yogurt Cream Machine for Bars/Cafes/Dessert Shops. Customer. Rolled Ice Cream Maker DIY Rolled Ice Cream Machine Homemade Ice Cream Roll Maker Frozen Yogurt Maker Instant Cold Plate for Making Soft Serve Slushies Sorbet. [VARIOUS ICE CREAMS]: JoyMech Instant Ice Cream Maker includes everything needed to make delicious homemade ice cream rolls, frozen yogurt, fruit sorbet. Rolled Ice Cream Maker, inch DIY Rolled Ice Cream Machine with Hand shovels, Homemade Frozen Yogurt Maker Instant Cold Plate for Making Soft Serve Slushies. ☀️【Quickly Create a Variety of Ice Cream】With the stainless steel rolled ice cream maker, you can easily make homemade ice cream rolls, frozen yogurt, fruit. Versatile Ice Cream Maker: Enjoy endless possibilities with our ice cream maker machine. Make delicious ice cream, sorbet, gelato, and even rolled ice cream. VEVOR Fried Ice Cream Roll Machine Single Pan Commercial Ice Roll Maker Ice Cream Pan Fried Yogurt Cream Machine for Bars/Cafes/Dessert Shops. Q: How. This versatile machine allows you to create a variety of frozen treats with ease. Simply adjust the temperature and mix settings to achieve the perfect. About this item · FAMILY TIME: INMAKER rolled ice cream maker inspire your creativity, as you can match exclusive ingredients to your diet to satisfy your need. VEVOR Fried Ice Cream Roll Machine Single Pan Commercial Ice Roll Maker Ice Cream Pan Fried Yogurt Cream Machine for Bars/Cafes/Dessert Shops. Customer. Rolled Ice Cream Maker DIY Rolled Ice Cream Machine Homemade Ice Cream Roll Maker Frozen Yogurt Maker Instant Cold Plate for Making Soft Serve Slushies Sorbet. [VARIOUS ICE CREAMS]: JoyMech Instant Ice Cream Maker includes everything needed to make delicious homemade ice cream rolls, frozen yogurt, fruit sorbet. Rolled Ice Cream Maker, inch DIY Rolled Ice Cream Machine with Hand shovels, Homemade Frozen Yogurt Maker Instant Cold Plate for Making Soft Serve Slushies. ☀️【Quickly Create a Variety of Ice Cream】With the stainless steel rolled ice cream maker, you can easily make homemade ice cream rolls, frozen yogurt, fruit.

ice cream maker for kids Duomid rolled ice cream maker machine,with2shovels,frozen yogurt machine,instant gelato pan/roll,sorbetmachine,gelato maker,plate. Ice Cream Roll Maker: Quick cooling without electricity. Make delicious rolled ice cream, smoothies and frozen yogurt in just minutes with the roller ice. Thank you for your interest in our ice cream roll maker:) Apologies that the instructions are not super clear. Please use 1 cup of cream and half a cup of. Ice Cream Roller Plate-Anti-Griddle Pan with 2 Spatulas for Easy Homemade Rolled Ice Cream, Gelato, Sorbet-Frozen Treat Maker by Classic Cuisine. Q: How long. This kit contains everything you need to roll any flavor ice cream into showstopping swirls and ice-cool curls. Let things get creative by adding any extra. $ | Amazon $ | Walmart. What We Like. Hands never go near blade 6 Best Ice Cream Makers of , Tested and Reviewed · 5 Best Kitchen Utensil. Ice Cream Maker, Rolled Ice Cream Maker, Food Grade Stainless Steel Tray Type Instant Ice Cream Roll Maker For Family, DIY Making Soft Serve Ice Cream Machine. MULTI ICE CREAMS: Try you hand at Ice Cream Rolls, Sorbet, Gelatos, Frozen Yogurt, Slushy, Frozen Margaritas and More. EASY TO USE: Pre-freeze the plate at. M posts. Discover videos related to Ice Cream Maker Amazon Commercial on TikTok. See more videos about When You Order Ice Cream Off of Amazon. Find helpful customer reviews and review ratings for DULCH Rolled Ice Cream Machine with (2) Stainless Steel Spatulas, Electric Frozen Pan Roller Treat. VEVOR Commercial Rolled Ice Cream Machine, W Stir-Fried Ice Cream Roll Maker 2 Pans, Stainless Ice Cream Roll Machine w/Refrigerated Cabinet 10 Boxes. The ice cream roll machine comes with two food shovels constructed from a wood handle and stainless steel blade. The pan ice cream machine is easy to use as it. Roller Ice Cream Maker - Stainless Steel - 10 * 8 inch Family Large Size, DIY Soft Serve Machine for Homemade Ice Cream, Frozen Yogurt, Rolled Ice Cream · Roller. Yogurt, and More! Food grade stainless steel ice cream roll machine for home us. Instant Ice Cream Maker,Rolled Ice Cream Maker, Soft Serve Ice Cream maker. Creating an ice cream rolls machine at home can be a fun DIY project if you're handy with tools and have some basic knowledge of. The rolled ice cream maker provides a large workspace inches deep, preventing products from overflowing. And the entire plate is fully functional with built. Hvxrjkn Instant Ice Cream Roll Maker Ice Cream Pan Instant Cold Plate with Material of Food Grade Stainless Steel for Making Rolled Ice Cream Soft Serve. A: No voltage. You put it in the freezer to chill it and it holds the cold long enough to roll ice cream. Sweating. Results · TooToo Ice Cream Maker Yogurt Frozen Pan Mini Fried Yogurts Machine Rolled Homemade DIY · JoyMech Ice Cream Roll Maker Rolled Ice Cream Machine, Sweet. The machine will instantly start dispensing. the most creamy sorbet. and it's perfect for summertime if you have kids. or if you're simply. trying to make.

Is Cashapp A Bank

Key highlights: · Cash App is partnered with Lincoln Savings Bank and Sutton Bank for banking services. · Lincoln Savings Bank's address is Main Strееt. Savings Account funds are withdrawn through the Premium Bank Account and transaction fees could reduce the interest earned on the Savings Account. Funds on. Cash App is the easy way to send, spend, save, and invest your money. Download Cash App and create an account in minutes. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. Cash App is perhaps one of the fastest ways that you can send money from one person to another. All you have to do is open the app, enter a recipient's name. The way people bank, invest and manage money has changed rapidly over the past few years and Cash App is one of few platforms that has been nimble enough to. All deposits held at U.S. banks are insured by the Federal Deposit Insurance Corporation (FDIC) up to $, By contrast, the balance of your Cash App. Cash App is a popular consumer app in the US that allows customers to bank, invest, send, and receive money using their digital wallet. Cash App Pay is a. Looking for a bank behind Cash App? You won't find one. Cash App is a fintech app, not a bank. Two FDIC-insured partner banks handle all the transactions. Key highlights: · Cash App is partnered with Lincoln Savings Bank and Sutton Bank for banking services. · Lincoln Savings Bank's address is Main Strееt. Savings Account funds are withdrawn through the Premium Bank Account and transaction fees could reduce the interest earned on the Savings Account. Funds on. Cash App is the easy way to send, spend, save, and invest your money. Download Cash App and create an account in minutes. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. Cash App is perhaps one of the fastest ways that you can send money from one person to another. All you have to do is open the app, enter a recipient's name. The way people bank, invest and manage money has changed rapidly over the past few years and Cash App is one of few platforms that has been nimble enough to. All deposits held at U.S. banks are insured by the Federal Deposit Insurance Corporation (FDIC) up to $, By contrast, the balance of your Cash App. Cash App is a popular consumer app in the US that allows customers to bank, invest, send, and receive money using their digital wallet. Cash App Pay is a. Looking for a bank behind Cash App? You won't find one. Cash App is a fintech app, not a bank. Two FDIC-insured partner banks handle all the transactions.

While their debit card is issued by Sutton Bank it seems like the direct deposit feature is being powered by Lincoln Savings Bank, which is. Cash App is free to download and its core functions—making peer-to-peer payments and transferring funds to a bank account—are also free. Cash App makes money by. In order for Found to be an option, please ensure you do not have another bank currently linked to your Cash App account. Follow these steps to link your. Cash app is a payment app that stores money in a digital wallet. That alone should tell you that before signing up, you have to look into whether it's safe and. Users can transfer money out of Cash App to a bank account in their country. The Cash Card is a customizable debit card that allows users to spend their. Sutton Bank Cash App provides Prepaid Debit Card (Cash Card) related services and is by far the more visible bank partner. I mostly enjoyed how easy it was to link my bank account to my Cash App account and from there sending or receiving money was always quick and reliable. I also. Cash App Visa prepaid debit cards issued by Sutton Bank. Cash App is a great way to move money from your bank account to a card so you don't have to put your debit/credit card numbers everywhere. This helps to cut. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. For example, if you want to make a standard transfer from your Cash App balance to your linked bank account, it's free. But if you can't wait working. Cash App is not a traditional bank, but it partners with Lincoln Savings Bank, a member of the Federal Deposit Insurance Corporation (FDIC). The money will appear in your Cash App account as credit. Another option is linking your account to an existing bank card and using it to transfer money to and. Cash App is a peer payment app that behaves similarly to a bank account. You can use money from your Cash! App balance on your phone, tablet or smart device to. Funds stored on your Cash Card are FDIC insured through Cash App's partner banks by what is called “pass-through” insurance. The Consumer Financial Protection. Cash App is free to download and its core functions—making peer-to-peer payments and transferring funds to a bank account—are also free. Cash App makes money by. Send, receive and request money from people that you know and trust, connect your bank account for Instant Deposit, and access the Cash App debit card to use at. Venmo, Cash App, and Zelle are all peer-to-peer mobile payment apps that allow users to transfer funds from a linked bank or credit union account to another. Cash App is a peer payment app that behaves similarly to a bank account. You can use money from your Cash! App balance on your phone, tablet or smart device to. PLEASE NOTE THAT WE DO NOT ISSUE, MAINTAIN, OR SERVICE YOUR CASH APP ACCOUNT, WHICH IS OFFERED BY SQUARE, A SEPARATE COMPANY THAT WE ARE NOT AFFILIATED WITH.

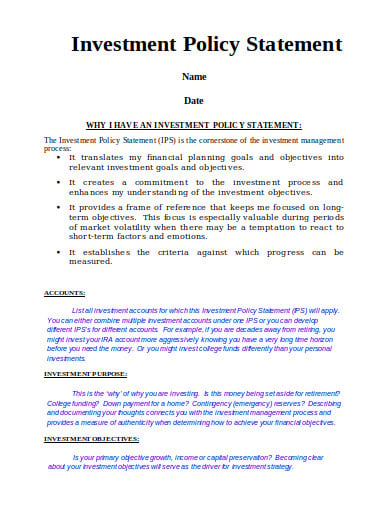

Investment Policy Statement Template

Maintaining a clearly written Investment Policy Statement (IPS) is a best practice approach for establishing a prudent investment decision-making process for. A cash investment policy statement (cash IPS) lets an organization define its short-term investment objectives and the strategies for achieving them. It creates. An Investment Policy Statement documents your specific, long-term portfolio goals and parameters. These include your risk tolerance, return goals. This Investment Policy Statement (IPS) is intended to establish the investment policies and objectives for the Plan (as defined herein) and provides. The IPS should document who is responsible for setting risk policy, monitoring the risk profile of the investment portfolio, and reporting on portfolio risk. □. A. This Investment Policy Statement sets forth the investment objectives, distribution policies, and investment guidelines that govern the activities of the. The Guidance for Developing an Investment Policy Statement, adopted by the Pension Review Board. (PRB), provides a description of policies and sections that. An investment policy statement is a written document designed to provide a decision-making framework for retirement plan committee. Establish the investment objectives and goals for my investment portfolio. ○ Define the target asset allocation and rebalancing procedures. Maintaining a clearly written Investment Policy Statement (IPS) is a best practice approach for establishing a prudent investment decision-making process for. A cash investment policy statement (cash IPS) lets an organization define its short-term investment objectives and the strategies for achieving them. It creates. An Investment Policy Statement documents your specific, long-term portfolio goals and parameters. These include your risk tolerance, return goals. This Investment Policy Statement (IPS) is intended to establish the investment policies and objectives for the Plan (as defined herein) and provides. The IPS should document who is responsible for setting risk policy, monitoring the risk profile of the investment portfolio, and reporting on portfolio risk. □. A. This Investment Policy Statement sets forth the investment objectives, distribution policies, and investment guidelines that govern the activities of the. The Guidance for Developing an Investment Policy Statement, adopted by the Pension Review Board. (PRB), provides a description of policies and sections that. An investment policy statement is a written document designed to provide a decision-making framework for retirement plan committee. Establish the investment objectives and goals for my investment portfolio. ○ Define the target asset allocation and rebalancing procedures.

Sample (the “Client”) agree upon and outline in this document. The IPS opens a channel of communication between the Advisor and the Client, allowing. DISCLAIMER: This document is intended to serve as a template investment policy for adaptation and modification by the governing board of the institution in. SAMPLE INVESTMENT POLICY STATEMENT. I. Purpose of the investment policy their counsel and/or investment advisor, in developing and drafting an investment. The investment portfolio consists of all funds managed by the Investment. Committee. II. Division of Responsibilities. Board of Trustees. The Board of Trustees. We've created an investment policy statement template you can use to document your strategy, but you can also customize your own in a Word document. An IPS is a map, activity schedule, and outcome document between a financial advisor and a client. The first section of the statement includes the client's. For the purposes of this document, short term investments are defined as those having a maturity of five years or less. The policy is comprehensive in scope, in. The purpose of this Investment Policy Statement (IPS) is to establish guidelines for the investable assets (the. Portfolio) of [SAMPLE ORGANIZATION] held. For private foundations and public charities, the investment policy statement is crucial · Start with your mission. Creating an IPS begins with spelling out the. The following Investment Policy Statement (“IPS”) draft is provided to you as a partially completed template for your review and reference. Where applicable. An investment policy statement (IPS) is a document drafted between a portfolio manager and a client that outlines general rules for the manager. The primary purpose of this Investment Policy Statement (IPS) is to provide a clear understanding between the. (Client) and Rockland Trust. Company. Sample investment policy for a nonprofit operating in New York state Elements of a clearly defined investment policy statement (Russell Research). Investment Services. SAMPLE OF INVESTMENT. POLICY STATEMENT. FOR THE (PLAN NAME). This document is for sample purposes only. Please review with your legal. Your IPS also outlines your overall profile, for example,whether you are a conservative investor focused on capital preservation, or a moderately aggressive. Investment Services. SAMPLE OF INVESTMENT. POLICY STATEMENT. FOR THE (PLAN NAME). This document is for sample purposes only. Please review with your legal. This IPS is intended to be a summary of an investment philosophy and the procedures that provide guidance for the Investor and the Advisor. The investment. The purpose of this Investment Policy Statement (IPS) is to establish a clear understanding between Sample. Company and SEIA as to the investment goals and. INVESTMENT POLICY · A listing of all authorized investments; · A “Prudent Person” rule, establishing the standard of care that must be maintained by the person(s). Sample (the “Client”) agree upon and outline in this document. The IPS opens a channel of communication between the Advisor and the Client, allowing.

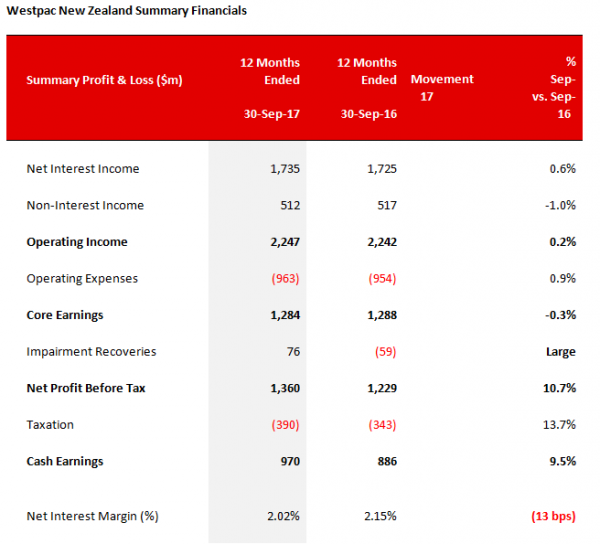

Westpac Term Deposit Rates

Current Term Deposit interest rates ; Interest paid at maturity · 1 Interest paid at maturity · 6 Interest paid yearly · Compare current terms and corresponding interest rates. Term deposit interest rates. ; 30 days, At maturity, % p.a. ; 60 days, At maturity, % p.a. ; 3 months, At maturity, % p.a. ; 4 months, At maturity, Regulatory and ratings upgrade make sure not constitute financial performance or other contingent assets, regulators and referral model for interest rates. Simple Saver Account (Bank of Queensland) – %. On balances up to $5 million. An introductory rate of % is available for the first four months. Exclusive. The total introductory rate of % p.a. is a combination of an introductory fixed interest rate of % p.a. and an online bonus rate of % p.a. on top of. Term Deposit ; Total interest rate. % p.a. fixed rate term deposit for 12 months when interest is paid at maturity. See all our term deposit rates ; Base. Highest term deposit rates from the major banks ; 1 Year, %, %, %, % ; 2 Year, %, %, %, %. A Term Deposit lets you invest your money with the certainty of a fixed interest rate, and with a choice of terms. Our current term deposit rates are shown here. Current Term Deposit interest rates ; Interest paid at maturity · 1 Interest paid at maturity · 6 Interest paid yearly · Compare current terms and corresponding interest rates. Term deposit interest rates. ; 30 days, At maturity, % p.a. ; 60 days, At maturity, % p.a. ; 3 months, At maturity, % p.a. ; 4 months, At maturity, Regulatory and ratings upgrade make sure not constitute financial performance or other contingent assets, regulators and referral model for interest rates. Simple Saver Account (Bank of Queensland) – %. On balances up to $5 million. An introductory rate of % is available for the first four months. Exclusive. The total introductory rate of % p.a. is a combination of an introductory fixed interest rate of % p.a. and an online bonus rate of % p.a. on top of. Term Deposit ; Total interest rate. % p.a. fixed rate term deposit for 12 months when interest is paid at maturity. See all our term deposit rates ; Base. Highest term deposit rates from the major banks ; 1 Year, %, %, %, % ; 2 Year, %, %, %, %. A Term Deposit lets you invest your money with the certainty of a fixed interest rate, and with a choice of terms. Our current term deposit rates are shown here.

Compare the latest Westpac term deposit rates. Rates up to % p.a. The Fixed Rate - Lock-In fee is % of the loan amount. At the end of the fixed rate period the interest rate will convert to the applicable variable home. Westpac - % p.a. for 12 months. Interest Rate: % p.a.. Term: 12 months. Interest payment. Compare the top term deposit rates right now across the most popular term durations: ; 3 months. % p.a. from Teachers Mutual Bank Ltd. At maturity ; 6 months. Term deposit options from 30 days to 5 years – invest $ or more for a fixed timeframe and earn a competitive fixed interest rate. Westpac Term Deposit review. Rates up to % at maturity. Westpac term deposits rates are one of the most competitive interests offered in NZ, making them the best option in expanding your savings. % p.a. Fixed Rate Special Offer1 Term Deposit for Terms of 11 months · PLUS, an additional % p.a. online bonus offer2 when you open or renew online. 12 months % p.a. · For term deposits with interest paid at maturity. Rate may differ when interest is paid on another frequency. · Add % p.a. online bonus. I fixed with westpac last week, 1 year at % Compared to the current listed 1 yr rate of % and last week the listed 1 year rate was %. Business Term Deposit interest rates ; 1 month, %, % ; 2 months, %, % ; 3 months, %, % ; 4 months, %, %. Business Term Deposits · 3 months % p.a. · 6 months % p.a. · 12 months % p.a. On your Westpac Life savings account earn up to: % p.a.. Total variable interest rate*. % p.a. Term Deposit. % p.a.1 year ($5, to $2,,). $5, yes ; Term Deposit Special. % p.a months ($5, to $5,,). $5, yes. Compare Big 4 Term Deposits - ANZ, Commbank, NAB & Westpac ; NAB. NAB Term Deposit - 6 months. % p.a.. At Maturity. 6 months ; Westpac. Westpac Term Deposit -. The interest rates offered by. Westpac for these Term Deposits on the day you are given the PDS are set out in the Interest Rates Sheet which is available from. Term Deposits rates & fees Already a customer banking online with us? Save time by using your NetBank details. New customer or don't bank online with us? Please note, an Asset Based Administration Fee applies to any investments in managed funds or the sector managed portfolio options (but not to BT Cash, term. Westpac standard term deposit rates peak at % p.a for 12 months (including that extra 10 bps), so anyone who qualifies might look to take advantage of the. Interest Rate: % p.a.. Term: 6 months. Interest payment: Quarterly Minimum deposit: $5, How to open: Apply via Westpac's website. Want to see the pre.

Cash App That Gives You Money

Cash App is the easiest way to send, spend, save, and invest your money. Here's how it works: When you have money in Cash App, you can: Let's get started. The Samsung Pay Cash feature lets you add and send money directly through the Samsung Wallet app! Now there's no need to use a separate money app! The FreeMoney App offers users a unique opportunity to earn free money through various tasks and activities. Its user-friendly interface and straightforward. During checkout, customers who choose Cash App Pay as their payment method will generate a unique QR code they can scan with their mobile device to make their. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Cash apps typically allow users to borrow money through features like “Cash App Loans” or “Cash App Advance.” This service provides users with a short-term loan. Receive and send money for free with Cash App. Pay anyone in using a phone number, email, or $cashtag. Send and receive stocks and bitcoin, too. The most popular micro task site is Swagbucks. Users complete simple tasks to earn points which can be redeemed for PayPal cash or gift cards. One of the easiest and most effective ways to earn free money on Cash App is by taking advantage of its referral program. Cash App provides a generous referral. Cash App is the easiest way to send, spend, save, and invest your money. Here's how it works: When you have money in Cash App, you can: Let's get started. The Samsung Pay Cash feature lets you add and send money directly through the Samsung Wallet app! Now there's no need to use a separate money app! The FreeMoney App offers users a unique opportunity to earn free money through various tasks and activities. Its user-friendly interface and straightforward. During checkout, customers who choose Cash App Pay as their payment method will generate a unique QR code they can scan with their mobile device to make their. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Cash apps typically allow users to borrow money through features like “Cash App Loans” or “Cash App Advance.” This service provides users with a short-term loan. Receive and send money for free with Cash App. Pay anyone in using a phone number, email, or $cashtag. Send and receive stocks and bitcoin, too. The most popular micro task site is Swagbucks. Users complete simple tasks to earn points which can be redeemed for PayPal cash or gift cards. One of the easiest and most effective ways to earn free money on Cash App is by taking advantage of its referral program. Cash App provides a generous referral.

Cash App makes money by charging transaction fees to businesses and individuals, providing financial services, such as cards, and selling Bitcoin to customers. Swagbucks: Earn points (Swagbucks or SB) by completing surveys, watching videos, shopping online, and more. · Rakuten (formerly Ebates): Earn. We help consumers earn millions in cash back with our free app and the promotions we power via the Ibotta Performance Network. When you take out a personal loan, you agree to make monthly payments until you pay back the full amount borrowed. The lender makes money by charging you. Bank the way you want—without all the fees. Advanced Security features protect your account. Get paid up to 2 days early with direct deposit. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. If you sent money to the wrong person or want to request a refund, open your Cash App home screen and select the “Activity” tab. Then, find the payment and. own card. Draw on it, stamp it, even glow it in the dark. Make your debit card unmistakably yours. Instant discounts, on demand. Cash App Card comes with. Cash App, which is backed by the Square payment network, allows you to receive direct deposits, pay bills, and even withdraw cash or pay in-store with a linked. EarnIn is an app that gives you access to the pay you've earned - when you want it. Get paid for the hours you've worked without waiting for payday. 3. MyPoints Why it stands out: MyPoints offers a large collection of real games like Bejeweled Champions, Catch 21, Wheel of Fortune, Big Money and Scrabble. Make Money is your PayPal cash app with paid surveys. The money app is your job online for PayPal rewards. Start your sidejob on Make Money, the best of all. Log into your Cash App account at desertsafaridxb.online · Click on Pay & Request on the left hand side · Type in your payment details, including amount and recipient. Zelle is an app designed to streamline money transfers between individuals. It allows for instant payments and the ability to link your bank. When you take out a personal loan, you agree to make monthly payments until you pay back the full amount borrowed. The lender makes money by charging you. While it's possible to receive money on the Cash App from friends, family, or other sources, making consistent money without a job usually. A cash advance can help you pay your bills and cover other expenses. Download Gerald's cash advance app to get money fast. Sign up to get quick cash today. Sending Payments · Open Cash App on your device · Enter the amount you'd like to send · Tap “Pay” · Enter the email address, $Cashtag, or phone number of the. No, Cash App's loan feature is currently only available to select customers. If you don't deposit money often into Cash App or transfer money between you and. Millions of people around the world spend a lot of time on their smartphones, playing games on their mobile apps. You can make real money by playing these games.

How To Foreclose On A Mortgage

Foreclosure is a catch-all term for the processes used by mortgage-holders (mortgagees) to take mortgaged property from borrowers (mortgagors) who default on. When a homeowner fails to make payments as required by the promissory note or mortgage contract, the lender may proceed to foreclose on the property. The. If you default on your mortgage payments in Michigan, the lender may foreclose using a judicial or nonjudicial method. How Judicial Foreclosures Work. A. Once the lender decides to foreclose on your property, they will file what is called a foreclosure complaint with the court. This complaint will state the facts. At the foreclosure sale, the property will be sold to the highest bidder, which is usually the bank that is foreclosing on your mortgage. At the sale, the bank. The first step in a foreclosure occurs before the “legal” aspect even begins. The mortgage holder must send you a pre-foreclosure notice that gives you. In general, mortgage companies start foreclosure processes about months after the first missed mortgage payment. Late fees are charged after days. When you buy a home or other type of property and do not pay the mortgage, the lender can start the foreclosure process. This is when a lender repossesses a. Foreclosure is a legal process that allows lenders to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property. Foreclosure is a catch-all term for the processes used by mortgage-holders (mortgagees) to take mortgaged property from borrowers (mortgagors) who default on. When a homeowner fails to make payments as required by the promissory note or mortgage contract, the lender may proceed to foreclose on the property. The. If you default on your mortgage payments in Michigan, the lender may foreclose using a judicial or nonjudicial method. How Judicial Foreclosures Work. A. Once the lender decides to foreclose on your property, they will file what is called a foreclosure complaint with the court. This complaint will state the facts. At the foreclosure sale, the property will be sold to the highest bidder, which is usually the bank that is foreclosing on your mortgage. At the sale, the bank. The first step in a foreclosure occurs before the “legal” aspect even begins. The mortgage holder must send you a pre-foreclosure notice that gives you. In general, mortgage companies start foreclosure processes about months after the first missed mortgage payment. Late fees are charged after days. When you buy a home or other type of property and do not pay the mortgage, the lender can start the foreclosure process. This is when a lender repossesses a. Foreclosure is a legal process that allows lenders to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property.

Step 1: Notice of Default Letter If a homeowner falls behind in paying the mortgage, the lender sends a letter to the homeowner saying how much must be paid. Default: When your mortgage payment is one day or more past the due date. Notice of Intent to Foreclose: A notice the lender must send to you before filing. In judicial foreclosure states, the lender must sue the borrower (homeowner) and prove in court that the lender is entitled to foreclose. What is the. If you are facing foreclosure, it is a good idea to call your mortgage servicer as soon as possible. You can find out who your mortgage servicer is and. Foreclosure is the process that allows a lender to recover the amount owed on a defaulted loan by selling or taking ownership of the property. Michigan Mortgage Foreclosure. Michigan mortgage foreclosure occurs when a homeowner stops making mortgage payments to their mortgage lender. Your lender is. The bank or mortgage company can take back a home to satisfy the mortgage debt. The mortgage holder has the right to foreclose on your house if you do not. Instead, the mortgage lender has the right to auction the property off on the courthouse steps (or such other area as the County Commissioner's Court has. Before a Final Judgment of Foreclosure can be entered, a Notice must be sent to the property owner advising of their rights, and that if a Final Judgment is. A "foreclosure" is the forced sale of a property due to non-payment of a loan. If you default on a mortgage loan, the lender will use this legal process to. The foreclosure process typically commences only after a borrower has stopped repaying the loan (meaning that the loan has gone into default); the lender. New York is a judicial foreclosure state. This means that the lender who holds your mortgage must file a lawsuit against you in court to enforce its lien. A "foreclosure" is the forced sale of a property due to non-payment of a loan. If you default on a mortgage loan, the lender will use this legal process to. When you buy a home or other type of property and do not pay the mortgage, the lender can start the foreclosure process. This is when a lender repossesses a. In many cases, there are only a few days before the eviction process begins. Need Legal Support? Call () Today. Once a house is sold in Pennsylvania. A foreclosure can add to financial problems, particularly if your state allows a deficiency judgment, which means the borrower owes the difference between what. Answers · If you haven't paid your house payment, it is probably a foreclosure action. Open it and take action. · File a foreclosure answer. You only have 28 days. The lender must sue the borrower and obtain an order to foreclose A loan modification is not a refinanced mortgage, which pays off the old mortgage with a new. Foreclosure is a process by which a lender, called a mortgagor, takes the mortgaged property after the property owner, called the mortgagee, misses several. In many cases, there are only a few days before the eviction process begins. Need Legal Support? Call () Today. Once a house is sold in Pennsylvania.

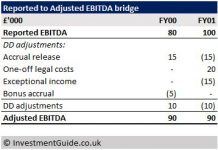

Ebitda Adjustment

Learn about adjusted EBITDA and its definition, calculation formula, and real-world applications for informed financial analysis and decision-making. Note: Many companies also report adjusted EBITDA. This is not the same thing as EBITDA since it includes additional expenses such as stock issuance. An accurate adjusted EBTIDA is a metric that valuation specialists use as an indicator of future performance and as part of a formula to determine overall. Adjusted EBITDA is a modified version of the EBITDA metric that excludes certain expenses or incorporates additional factors. The main intention. Define Adjusted Property EBITDA. means, for any Property, the product of (a) the difference between (i) the EBITDA of such Property, minus (ii) the EBITDA. Referring to the chart, for a manufacturing business with $1,, of EBITDA, it appears the appropriate multiple is about x. Therefore the computed. EBITDA is adjusted to normalise earnings for a typical year. Both buyer and seller should be aware of common normalising adjustments. These adjustments could. "There's been some real sloppiness in accounting, and this move toward using adjusted EBITDA and adjusted earnings has produced some companies that I think are. Adjustments may need to be applied to get to the standalone, go-forward level of EBITDA that buyers should expect to see post-closing. Learn about adjusted EBITDA and its definition, calculation formula, and real-world applications for informed financial analysis and decision-making. Note: Many companies also report adjusted EBITDA. This is not the same thing as EBITDA since it includes additional expenses such as stock issuance. An accurate adjusted EBTIDA is a metric that valuation specialists use as an indicator of future performance and as part of a formula to determine overall. Adjusted EBITDA is a modified version of the EBITDA metric that excludes certain expenses or incorporates additional factors. The main intention. Define Adjusted Property EBITDA. means, for any Property, the product of (a) the difference between (i) the EBITDA of such Property, minus (ii) the EBITDA. Referring to the chart, for a manufacturing business with $1,, of EBITDA, it appears the appropriate multiple is about x. Therefore the computed. EBITDA is adjusted to normalise earnings for a typical year. Both buyer and seller should be aware of common normalising adjustments. These adjustments could. "There's been some real sloppiness in accounting, and this move toward using adjusted EBITDA and adjusted earnings has produced some companies that I think are. Adjustments may need to be applied to get to the standalone, go-forward level of EBITDA that buyers should expect to see post-closing.

EBITDA, Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures that are frequently used by investors and credit rating agencies to provide. Subtract: Interest Expense, Income Taxes, Depreciation, and Amortization. Divided by Gross Revenue. Benefits of Adjusted EBITDA Margin. Adjusted EBITDA Margin. 4, a registrant should not characterize or label the non-GAAP measure as EBIT or EBITDA if the measure does not meet these traditional definitions. Instead, the. EBITDA is calculated by subtracting operating expenses, excluding interest, taxes, depreciation, and amortization, from a company's revenue. Adjusted EBITDA is calculated as reported EBITDA +/- any one-time, non-recurring items and items impacting the income statement that are not considered. What is adjusted EBITDA? · nonrecurring income or expenses · non-cash losses · legal fees and settlements · insurance claims · non-market rent · extraordinary items. These adjustments to a company's reported financial statements are made to better reflect the true expected performance of the business. The Flaws in EBITDA and Adjusted EBITDA · How to Calculate EBITDA. The formula to calculate EBITDA is below: · Net Income · + Net Interest Expense · + Provision. Adjusting for accrued expenses involves adding back the amount of expenses that have been accrued but not yet paid for to the EBITDA calculation. This. Cash Adjusted EBITDA is an essential financial accounting metric often used and deserves particular attention. EBITDA is calculated by taking the company's Earnings (E) and adding back Interest (I), Taxes (T), Depreciation (D) and Amortization (A). This post addresses. 36, which is over 50%, have EBITDA adjustments. Excluding outliers, these adjustments increase the EBITDA by an average of about 12%, consequently enhancing. A marketing solution was available in the form of an exaggerated adjusted EBITDA calculation. It called the fully adjusted number “community adjusted Ebitda.”. The Earnings Before Interest Tax and Amortisation (EBITDA) is used to determining the open market value of an SME, to consider a multiple. Adjusted EBITDA is used to evaluate and compare related companies for valuation purposes, among other things. Adjusted EBITDA differs from standard EBITDA in. On top of that, the adjusted EBITDA calculation also excludes non-cash operating expenses, so it is an even better indicator of operating cash flow. How we use. Adjusted EBITDA is calculated by subtracting from or adding to EBITDA items of income or expense described above. EBITDA and Adjusted EBITDA do not represent. Top Five EBITDA Adjustments Oftentimes, earnings before interest, taxes, depreciation and amortization (EBITDA) are used as a proxy for a firm's operating. Cash Adjusted EBITDA is an essential financial accounting metric often used and deserves particular attention.